Vona's Robinson Tax Refund Check: A Deep Dive Into What It Is And Why It Matters

You’ve probably heard about Vona’s Robinson tax refund check, but do you really know what it is? This isn’t just another number on your paycheck or some random government policy. It’s a real deal that could affect your wallet—and we’re not talking pocket change here. Whether you’re a seasoned tax expert or someone who just files their taxes once a year, understanding this concept is crucial. Let’s break it down step by step so you can get the most out of your hard-earned money.

Taxes are one of those things in life that no one likes to think about until they absolutely have to. But when it comes to Vona’s Robinson tax refund check, there’s actually some good news waiting for you. This specific type of refund has been making waves because it offers taxpayers a chance to recover money they didn’t even realize they were owed. So buckle up, because we’re diving deep into the world of tax refunds.

Now, before we jump into all the nitty-gritty details, let me just say this: knowledge is power. Knowing how Vona’s Robinson tax refund works will not only help you save more cash but also ensure you don’t miss out on any opportunities to claim what’s rightfully yours. And who doesn’t want that? Keep reading, and I’ll walk you through everything you need to know.

Read also:How To Make Iron Man Suit In Minecraft Your Ultimate Guide

What Exactly Is Vona's Robinson Tax Refund Check?

Alright, let’s start with the basics. Vona’s Robinson tax refund check refers to a specific type of tax refund that arises from a legal settlement involving improper tax withholdings. In simpler terms, if the government accidentally took too much money from your paycheck, this refund ensures you get it back. It’s like getting a surprise gift in the mail—but way better because it’s YOUR money.

Here’s where it gets interesting: many people aren’t even aware they qualify for this refund. That’s why staying informed is key. The Robinson case specifically dealt with issues related to tax credits and deductions, meaning certain individuals might be eligible for a substantial amount of money without realizing it.

So, how does it work? Essentially, the government reviews cases where taxpayers may have overpaid their taxes due to errors in calculation or miscommunication. Once these errors are identified, the IRS sends out checks to those affected. Sounds pretty sweet, right?

Who Qualifies for Vona's Robinson Tax Refund?

Not everyone qualifies for Vona’s Robinson tax refund check, but don’t let that discourage you. There’s a good chance you might be one of the lucky ones. To qualify, you typically need to meet certain criteria:

- Have filed taxes within the past three years

- Have claimed specific tax credits (like the Earned Income Tax Credit)

- Have experienced discrepancies in your reported income versus actual income

It’s important to note that eligibility can vary depending on individual circumstances. For instance, if you’ve recently moved or changed jobs, you might want to double-check your records to ensure everything matches up correctly. Small mistakes can lead to big refunds!

Why Is Vona's Robinson Tax Refund Important?

Let’s face it—money talks. Vona’s Robinson tax refund check is important because it directly impacts your financial well-being. Think about it: if you’re owed thousands of dollars by the government, wouldn’t you want to know about it? This refund isn’t just a nice bonus; it’s an opportunity to improve your financial situation.

Read also:Bela Sardines Review A Deep Dive Into The Hottest Trend In The Snack World

Moreover, understanding your rights as a taxpayer empowers you to make smarter decisions. By staying informed about programs like Vona’s Robinson tax refund, you can avoid common pitfalls and maximize your returns. Knowledge really is power in this case.

How Much Can You Expect to Receive?

The amount you can expect to receive from Vona’s Robinson tax refund varies depending on several factors, including:

- Your income level

- The specific tax credits you claimed

- Any discrepancies found in your tax filings

On average, eligible taxpayers can expect to receive anywhere from a few hundred dollars to several thousand dollars. Of course, the exact amount will depend on your unique situation. But hey, even a small refund is better than nothing, right?

How to Check If You Qualify

Checking your eligibility for Vona’s Robinson tax refund check is easier than you might think. Here’s a quick guide to help you get started:

Step 1: Gather your past tax documents. You’ll need your W-2 forms, 1099s, and any other relevant paperwork.

Step 2: Review your filings for the past three years. Look for any discrepancies or errors that might indicate overpayment.

Step 3: Use the IRS’s online tools to check your status. They offer a variety of resources to help taxpayers identify potential refunds.

Step 4: If you’re still unsure, consult with a tax professional. Sometimes, having a second opinion can make all the difference.

Common Mistakes to Avoid

When it comes to Vona’s Robinson tax refund, there are a few common mistakes you’ll want to avoid:

- Not keeping accurate records of your income and expenses

- Missing deadlines for filing amendments or appeals

- Assuming you don’t qualify without doing proper research

By staying organized and proactive, you can increase your chances of receiving the refund you deserve. Remember, the IRS isn’t out to get you—they’re just following the rules. Your job is to make sure those rules work in your favor.

Understanding the Legal Background

Let’s take a moment to delve into the legal background behind Vona’s Robinson tax refund. This case originated from a lawsuit filed against the IRS for improperly calculating tax liabilities. The settlement resulted in a massive payout to affected taxpayers, highlighting the importance of holding government agencies accountable.

Interestingly, the Robinson case also shed light on broader issues within the tax system. Many experts argue that similar cases could arise in the future, emphasizing the need for continued vigilance among taxpayers. As the saying goes, “forewarned is forearmed.”

Key Players in the Robinson Settlement

The Robinson settlement involved several key players, including:

- Vona Robinson herself, the plaintiff in the case

- The IRS, who was responsible for addressing the errors

- Legal representatives who fought tirelessly for taxpayer rights

Each of these individuals played a crucial role in ensuring justice was served. Their efforts paved the way for thousands of taxpayers to recover lost funds.

How to File for Vona's Robinson Tax Refund

Filing for Vona’s Robinson tax refund doesn’t have to be a headache. Follow these simple steps to get started:

Step 1: Contact the IRS directly to request a review of your case.

Step 2: Submit any necessary documentation, such as amended tax returns or proof of income.

Step 3: Be patient while the IRS processes your request. They receive thousands of applications daily, so it may take some time.

Step 4: If approved, you’ll receive your refund check in the mail. Easy peasy!

Tips for a Smooth Filing Process

To ensure a smooth filing process, keep these tips in mind:

- Double-check all your paperwork for accuracy

- Keep copies of everything you submit

- Follow up with the IRS if you don’t hear back within a reasonable timeframe

By staying organized and persistent, you’ll increase your chances of success.

Common Questions About Vona's Robinson Tax Refund

Here are some frequently asked questions about Vona’s Robinson tax refund:

Can I Still File If I Missed the Deadline?

Technically, the IRS has strict deadlines for filing amendments. However, in certain cases, they may grant extensions or exceptions. It’s always worth reaching out to clarify your situation.

Do I Need a Lawyer to File?

While hiring a lawyer isn’t mandatory, it can certainly help if your case is complex. A qualified attorney can guide you through the process and ensure you don’t miss any critical details.

What Happens If My Refund Is Denied?

If your refund is denied, don’t panic. You have the right to appeal the decision. Gather all relevant evidence and present your case to the IRS for reconsideration.

Conclusion: Take Action Today!

In conclusion, Vona’s Robinson tax refund check is a game-changer for many taxpayers. By understanding how it works and taking the necessary steps to file, you can reclaim money that rightfully belongs to you. Don’t wait—start reviewing your tax records today!

And remember, the more informed you are, the better equipped you’ll be to navigate the often-complicated world of taxes. So share this article with friends and family, leave a comment below, or explore other resources on our site. Together, we can make sure everyone gets the refunds they deserve.

Table of Contents

- What Exactly Is Vona's Robinson Tax Refund Check?

- Who Qualifies for Vona's Robinson Tax Refund?

- Why Is Vona's Robinson Tax Refund Important?

- How Much Can You Expect to Receive?

- How to Check If You Qualify

- Understanding the Legal Background

- How to File for Vona's Robinson Tax Refund

- Common Questions About Vona's Robinson Tax Refund

- Conclusion: Take Action Today!

How To Say River In French: A Comprehensive Guide For Language Enthusiasts

Mustang OK Fireworks 2024: A Spectacular Night Under The Stars

How To Spell Whisky: A Comprehensive Guide To Mastering The Art Of Writing Whisky

Agent Vona Robinson

Vona Robinson's Contributions to the Bureau of Fiscal Service

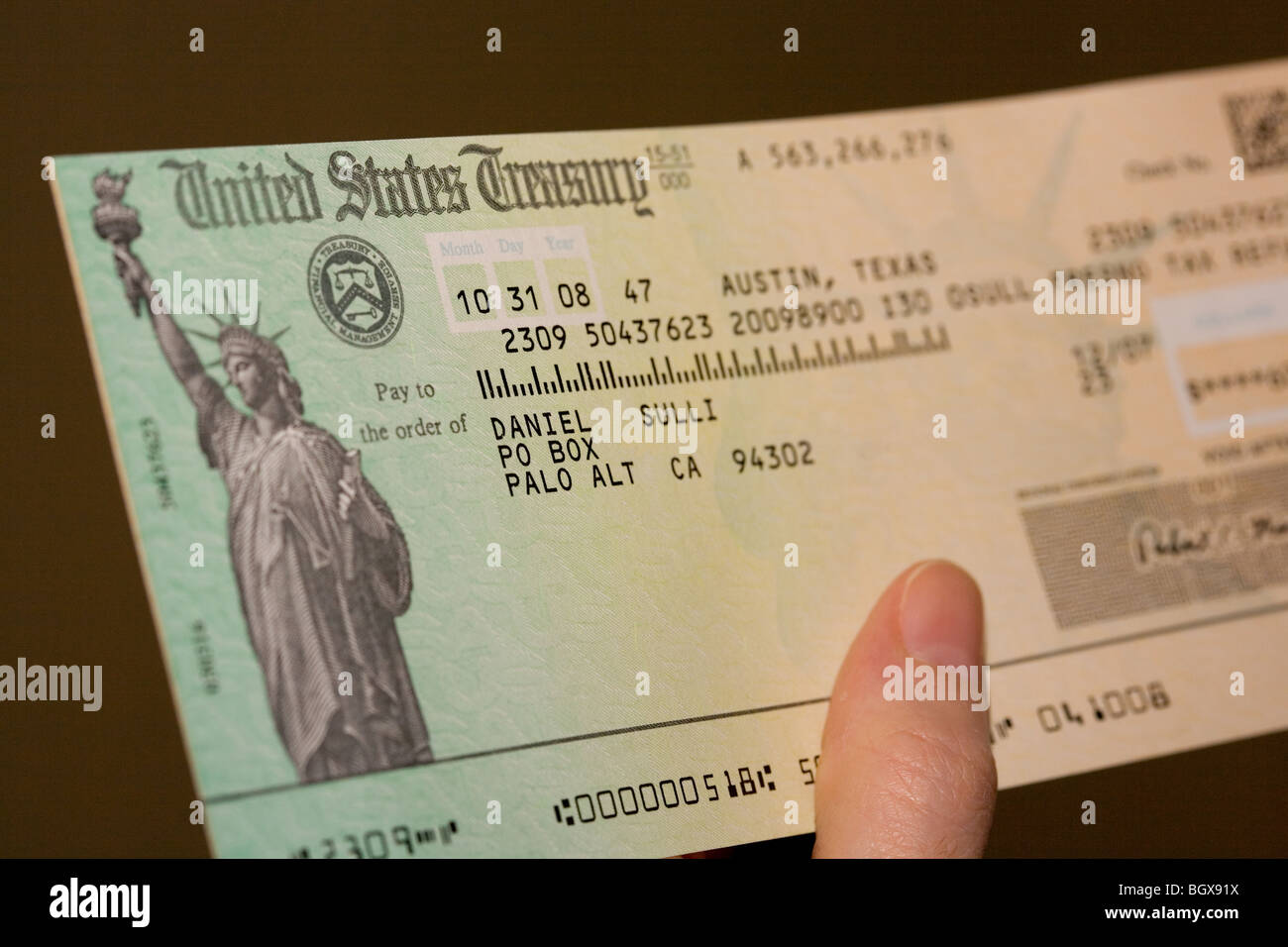

Tax refund check Stock Photo 27622726 Alamy